I usually shy away from writing too much about work happenings on my blog, mainly because I used to switch jobs so often in the past that I tried not to expose too much to future employers, but I've more or less settled down now

and would like to continue working at my current job for as long as they'll permit me to.

With that said, we found out Friday that they are cutting everyone's salaries by 10% for the next 3 months, and possibly further if sales don't improve. Our company seemed to be doing ok, at least from what limited knowledge I had. We had two layoffs back

last November & December but no further layoffs since then. I was a bit surprised, and disheartened when I found out my paycheck would be 10% less each month.

I suppose the alternative would have been laying off another 30 or so people and our staff, at least in my department, is already bare bones with each of us very specialized in our job duties. This leads me to wonder who we could have possibly even let go had that

been the route taken.

Mint.com To The Rescue...Sort Of

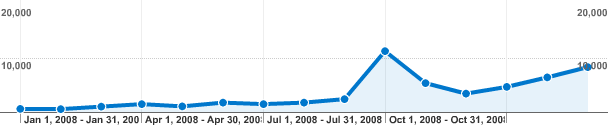

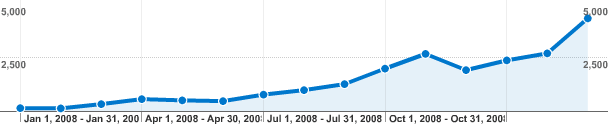

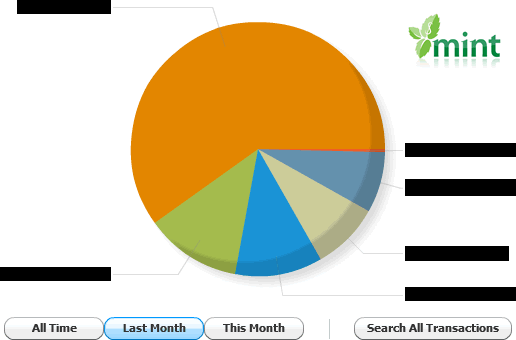

The 10% less is going to be really hard on me to make my monthly payments. In April, I made a major effort trying to scrape up some more money using my favorite budget tool Mint.com. Mint.com imports your debit card transactions

and groups them into categories. You can then trend these categories from month to month seeing where your money went. I highly recommend the site for someone keeping a tight budget as it helps you identify where all your money is going. By doing this you can then

make the necessary adjustments in the following months to spend less in that particular category. It also allows tagging, which I use to identify excess or wasteful spending. For the month of April I managed to get my excess spending down to $6. In past months it was

much, much higher than that. This is what depresses me the most, I spent $6 in excess spending in April only to get my pay cut by 10%.

Car Swap

In April, I also proposed swapping cars with Emily, a deal that benefited both of us. The car I was driving had her name on the title and I was paying her Mom for it. The car she

was driving had a higher monthly payment and had both our names on the title. We swapped cars and I sold my car to my Uncle Harry (Thanks Harry!). Since I was carless my parents decided to borrow me their car until I could save up some money for my

own. This was to save me $100 a month by not having a car payment anymore.

Who Needs Retirement

The other cost saving measure I took was zeroing out my 401k deduction from my paychecks. I had it at a reasonable amount but in order to save more money a month I bottomed it out.

A Futile Effort

Unfortunately all of this was a futile effort, because I've now taken one step forward and two steps back. I'm probably being melodramatic, but it's my blog so let me whine! I think, with the paycut I'm going to end up being worse off than where I started.

It's to bad I could forfeit my health insurance or some other useless benefit that I don't use in order to gain my 10% back, but I guess I'll just have to be even tighter with my money from now on. Heck maybe I can save that $6 in excess spending next month.

Really, the bain of my existence is my house, my life's second biggest mistake. If I could just sell my house, life would be dramatically different. While I really like my house, and being in it, it isn't helping me paying 2x the amount I could pay for a lush

apartment.

Well, I think I'm finished complaining for now. Thanks for reading the whole thing.

...

View Comments (2)